The Problem

Enhanced Premium Tax Credits Are on the Verge of Expiration

Introduced by the American Rescue Plan Act in 2021, Enhanced Premium Tax Credits have significantly reduced individual healthcare costs and expanded access to quality coverage through the Marketplace.

Unless Congress acts, these credits will expire in 2025.

Why it Matters

Coverage loss

Up to 5 million Americans† could lose their health coverage entirely, while millions more would pay significantly higher premiums.

Economic harm

Access to emergency care is vital, but reliance on ERs for routine care would increase, straining hospitals and driving up premiums for everyone.

Higher premiums

Millions of Americans could see premium increases ranging from $1,350 to $17,500† annually, depending on age, income, and health risks.

The Impact in Louisiana Campaign

Over 204,000 Louisianians relied on enhanced premium tax credits in 2024†.

A Louisiana couple in their early 60s earning about $80,000 per year would see their annual health insurance premium increase by an average of $17,170†. To keep their coverage, they could have no choice but to incur debt or forego medical care in order to reduce expenses.

Learn more about the impact of enhanced premium tax credits in your state.

Alaska

23,000 Alaskans relied on enhanced premium tax credits in 2024†.

An Alaska couple in their early 60s earning about $103,000 per year would see their annual health insurance premium increase by an average of $43,946†. To keep their coverage, they could have no choice but to incur debt or forego medical care in order to reduce expenses.

California

Over 1.5 million Californians relied on enhanced premium tax credits in 2024†.

A California couple in their early 60s earning about $80,000 per year would see their annual health insurance premium increase by an average of $16,563†. To keep their coverage, they could have no choice but to incur debt or forego medical care in order to reduce expenses.

Colorado

Over 183,000 Coloradans relied on enhanced premium tax credits in 2024†.

A Colorado couple in their early 60s earning about $80,000 per year would see their annual health insurance premium increase by an average of $13,038†. To keep their coverage, they could have no choice but to incur debt or forego medical care in order to reduce expenses.

Florida

Over 4 million Floridians relied on enhanced premium tax credits in 2024†

A Florida couple in their early 60s earning about $80,000 per year would see their annual health insurance premiums increase by an average of $13,539†. To keep their coverage, they could have no choice but to incur debt or forego medical care in order to reduce expenses.

Georgia

Over 1.2 million Georgians relied on enhanced premium tax credits in 2024†.

A Georgia couple in their early 60s earning about $80,000 per year would see their annual health insurance premium increase by an average of $16,114†. To keep their coverage, they could have no choice but to incur debt or forego medical care in order to reduce expenses.

Idaho

Over 90,000 Idahoans relied on enhanced premium tax credits in 2024†.

An Idaho couple in their early 60s earning about $80,000 per year would see their annual health insurance premium increase by an average of $15,788†. To keep their coverage, they could have no choice but to incur debt or forego medical care in order to reduce expenses.

Indiana

Over 263,000 Indiana residents relied on enhanced premium tax credits in 2024†.

An Indiana couple in their early 60s earning about $80,000 per year would see their annual health insurance premium increase by an average of $12,769†. To keep their coverage, they could have no choice but to incur debt or forego medical care in order to reduce expenses.

Kansas

Over 160,000 Kansans relied on enhanced premium tax credits in 2024†.

A Kansas couple in their early 60s earning about $80,000 per year would see their annual health insurance premium increase by an average of $18,502†. To keep their coverage, they could have no choice but to incur debt or forego medical care in order to reduce expenses.

Kentucky

Over 63,000 Kentucky residents relied on enhanced premium tax credits in 2024†.

A Kentucky couple in their early 60s earning about $80,000 per year would see their annual health insurance premium increase by an average of $15,184†. To keep their coverage, they could have no choice but to incur debt or forego medical care in order to reduce expenses.

Louisiana

Over 204,000 Louisianans relied on enhanced premium tax credits in 2024†.

A Louisiana couple in their early 60s earning about $80,000 per year would see their annual health insurance premium increase by an average of $17,170†. To keep their coverage, they could have no choice but to incur debt or forego medical care in order to reduce expenses.

Missouri

Over 338,000 Missourians relied on enhanced premium tax credits in 2024†.

A Missouri couple in their early 60s earning about $80,000 per year would see their annual health insurance premium increase by an average of $17,592†. To keep their coverage, they could have no choice but to incur debt or forego medical care in order to reduce expenses.

Nevada

Over 85,000 Nevadans relied on enhanced premium tax credits in 2024†.

A Nevada couple in their early 60s earning about $80,000 per year would see their annual health insurance premium increase by an average of $13,929.† To keep their coverage, they could have no choice but to incur debt or forego medical care in order to reduce expenses.

New Hampshire

Over 47,000 New Hampshirites relied on enhanced premium tax credits in 2024†.

A New Hampshire couple in their early 60s earning about $80,000 per year would see their annual health insurance premium increase by an average of $9,073†. To keep their coverage, they could have no choice but to incur debt or forego medical care in order to reduce expenses.

North Carolina

Over 980,000 North Carolinians relied on enhanced premium tax credits in 2024†.

A North Carolina couple in their early 60s earning about $80,000 per year would see their annual health insurance premium increase by an average of $19,296†. To keep their coverage, they could have no choice but to incur debt or forego medical care in order to reduce expenses.

South Carolina

Over 547,000 South Carolinians relied on enhanced premium tax credits in 2024†.

A South Carolina couple in their early 60s earning about $80,000 per year would see their annual health insurance premium increase by an average of $16,774†. To keep their coverage, they could have no choice but to incur debt or forego medical care in order to reduce expenses.

Tennessee

Over 526,000 Tennesseans relied on enhanced premium tax credits in 2024†.

A Tennessee couple in their early 60s earning about $80,000 per year would see their annual health insurance premium increase by an average of $18,086†. To keep their coverage, they could have no choice but to incur debt or forego medical care in order to reduce expenses.

Texas

Over 3.3 million Texans relied on enhanced premium tax credits in 2024†.

A Texas couple in their early 60s earning about $80,000 per year would see their annual health insurance premium increase by an average of $14,922†. To keep their coverage, they could have no choice but to incur debt or forego medical care in order to reduce expenses.

Utah

Over 350,000 Utahns relied on enhanced premium tax credits in 2024†.

A Utah couple in their early 60s earning about $80,000 per year would see their annual health insurance premium increase by an average of $17,038†. To keep their coverage, they could have no choice but to incur debt or forego medical care in order to reduce expenses.

Virginia

Over 350,000 Virginians relied on enhanced premium tax credits in 2024†.

A Virginia couple in their early 60s earning about $80,000 per year would see their annual health insurance premium increase by an average of $11,435†. To keep their coverage, they could have no choice but to incur debt or forego medical care in order to reduce expenses.

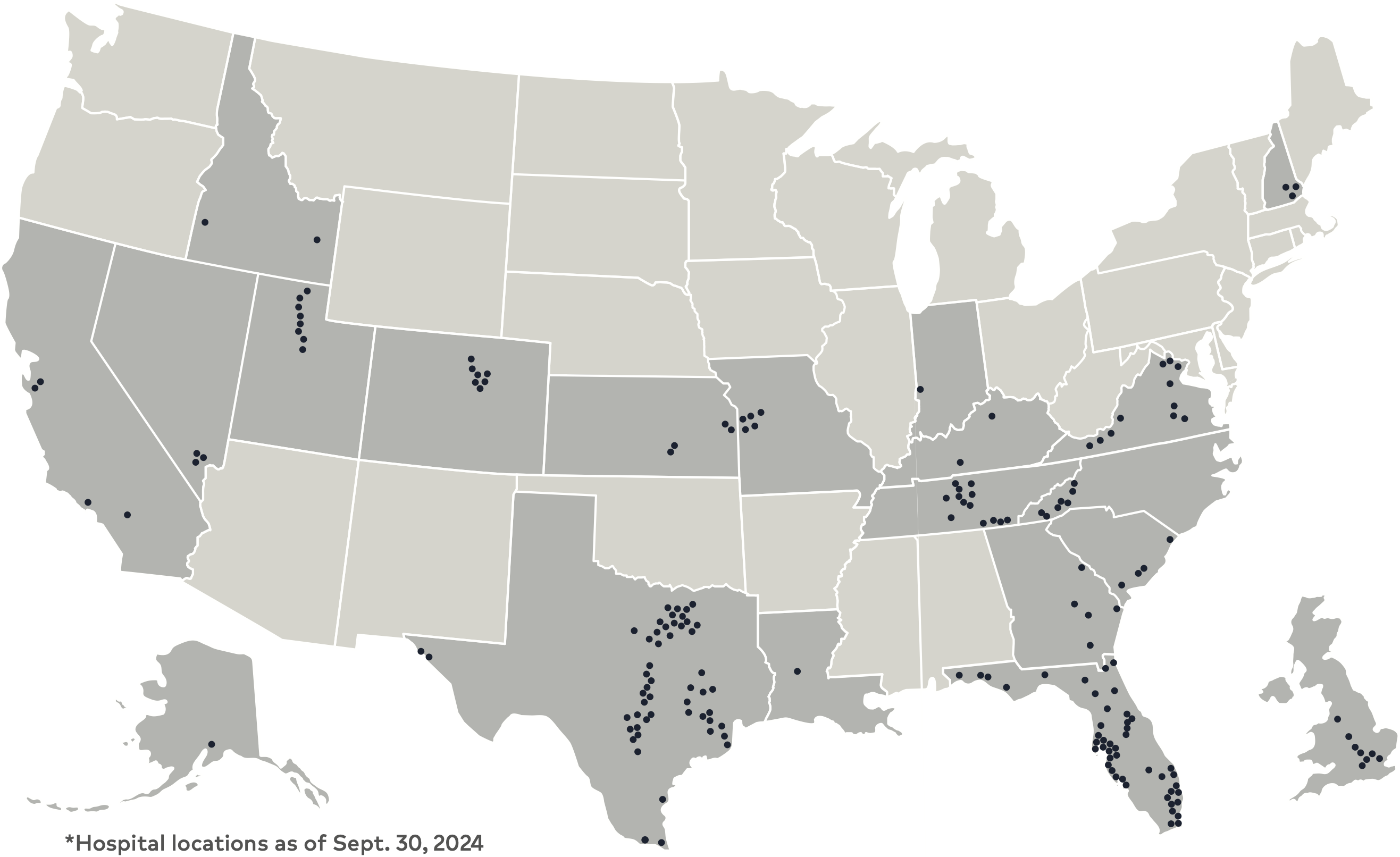

How Does Your Division Compare?

Each division of HCA Healthcare is working hard to advocate for enhanced premium tax credits. View the Ambassador Map to see which regions are leading the way in advocating for enhanced premium tax credits.

The Ambassador Map will be updated weekly.

Ready to advocate for affordable healthcare?

For more information on enhanced premium tax credits, please visit Keep Americans Covered. To see how much your coverage cost will increase, please use Keep Americans Covered's Tax Credit Comparison Calculator.